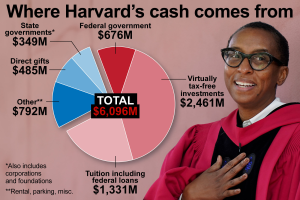

The Harvard Endowment, currently valued at a remarkable $53 billion, plays a crucial role in the financial landscape of Harvard University, influencing everything from its operational budget to financial aid offerings. As one of the largest university endowments in the world, it allows Harvard flexibility in managing its resources while also posing challenges that require astute endowment management strategies. With significant portions of the fund restricted and earmarked for specific purposes, understanding the nuances of the endowment is essential as Harvard navigates an ever-changing financial environment. Moreover, the recent political climate surrounding educational funding has raised questions about the sustainability of the Harvard budget and its ability to support financial aid programs. Balancing immediate financial needs against long-term investment goals is critical for Harvard to maintain its esteemed position in higher education and ensure equitable access for future students.

Harvard’s financial reservoir, often referred to as its endowment, serves as a pivotal asset in shaping the university’s fiscal policies and resource allocation. This substantial fund is fundamental to supporting a myriad of initiatives, including budgetary requirements, campus projects, and student financial assistance. As discussions about endowment management strategies intensify, it’s evident that the intricate layers of funding restrictions must be navigated with precision. The impact of Harvard University’s finances extends beyond mere numbers; it significantly influences the quality of education and accessibility afforded to its students. In an era where financial aid is crucial, the management of this foundational resource remains a topic of paramount importance.

Understanding the Harvard Endowment’s Role in University Finances

The Harvard endowment plays a pivotal role in the university’s financial ecosystem, providing essential funding for various initiatives including academic programs, research, and crucial financial aid. With an astounding value of $53 billion, the endowment might seem like an endless source of financial support. However, it’s important to remember that a significant portion of these funds comes with donor-imposed restrictions, thereby limiting the university’s financial flexibility. This means that the actual resources available for discretionary spending, which includes budgetary decisions that can address immediate needs, is much less than the total endowment figure suggests.

Moreover, the complexities of endowment management highlight the balancing act that Harvard’s leadership faces. While the endowment can indeed provide relief during fiscal unpredictability—such as the recent political and economic challenges—it must be managed carefully to ensure sustainability for future generations. Decisions made using endowment funds can create a ripple effect on the university’s overall financial health, influencing not just current budgets, but long-term financial strategies.

Frequently Asked Questions

What is the current status of Harvard University’s endowment?

As of the fiscal year 2025, Harvard University’s endowment is valued at a record-setting $53 billion. This substantial endowment allows for financial flexibility, although it’s important to note that most of it is restricted by donors for specific purposes.

How does Harvard manage its endowment resources?

Harvard’s endowment management strategy involves careful stewardship and long-term investment planning, aiming for an average return of 8 percent. The Harvard Management Company oversees its investment activities to ensure sustainable funding for various University operations.

What portion of the Harvard endowment is unrestricted for use by the University?

Less than 5 percent of Harvard’s endowment is unrestricted, meaning the vast majority is allocated to specific funds based on donor restrictions. This limits Harvard leaders’ discretion in budget management.

How does Harvard’s endowment support financial aid?

A significant portion of the annual distribution from Harvard’s endowment is allocated to financial aid, allowing the University to offer generous assistance to students. This policy is vital for maintaining accessibility to education at Harvard.

What risks does Harvard University face with its endowment management?

Harvard faces various risks in its endowment management, including potential losses during economic downturns, changes in federal funding policies, and the recent threat of losing tax-exempt status, all of which could impact long-term financial stability.

How does Harvard’s endowment influence its budget planning?

Harvard’s endowment significantly influences its budget planning. While it provides resources for current operations, drawing from the endowment can create future budgetary constraints. It’s a delicate balance between meeting immediate needs and ensuring long-term financial health.

What strategies does Harvard employ during financial crises?

During financial crises, Harvard may adjust its payout rate from the endowment, increase distributions for urgent needs, and consider borrowing against future revenues to address budget shortfalls, ensuring that it can meet pressing demands while strategically managing resources.

How can potential changes in federal policies affect Harvard’s endowment?

Changes in federal policies, such as the freezing of research grants or alterations in tax-exempt status, could substantially affect Harvard’s endowment by limiting funding sources, which would necessitate considerable adjustments in spending and revenue strategies.

What lessons can be drawn from Harvard’s endowment regarding long-term financial planning?

Lessons from Harvard’s endowment underscore the importance of long-term financial planning, including maintaining a balanced approach to spending, preparing for economic volatility, and ensuring that today’s decisions do not compromise future financial health.

What role does the Harvard Management Company play in endowment growth?

The Harvard Management Company is responsible for overseeing the investment strategies of the University’s endowment, aiming to achieve strong returns that support Harvard’s long-term financial goals, ensuring that the endowment can sustain its operations and strategic initiatives.

| Aspect | Details |

|---|---|

| Endowment Value | As of fiscal year beginning 2025, Harvard’s endowment is valued at a record $53 billion. |

| Restricted Funds | The majority of the endowment is restricted by donors and designated for specific purposes. |

| Unrestricted Funds | Less than 5% of the endowment is unrestricted and available for immediate use by University leadership. |

| Financial Risks | Recent political tensions could risk billions in research grants and potentially affect Harvard’s tax-exempt status. |

| Budget Challenges | Endowment funds are often used to cover budget deficits, limiting future funding options. |

| Long-term Planning | Decisions regarding endowment withdrawals today affect future budgets and financial flexibility. |

| Economic Volatility | The endowment management approach aims to mitigate risks from market volatility and economic crises. |

| Future Adjustments | Radical changes may be necessary in response to reduced funding from external sources. |

Summary

The Harvard Endowment serves as a significant financial pillar for Harvard University, currently standing at an impressive $53 billion. However, this substantial figure masks challenges stemming from restricted funds and mounting financial pressures. Recently, external political factors have posed risks to future funding, prompting urgent considerations regarding budget management and long-term planning. The reliance on endowment income to cover budget shortfalls raises concerns about sustainability and financial flexibility. Moving forward, it is essential for Harvard to adopt a thorough strategic approach that balances immediate needs with prudent long-term investment strategies to ensure the continued success and stability of the Harvard Endowment.