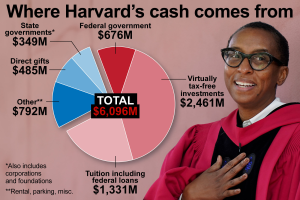

Harvard endowment management plays a pivotal role in the financial landscape of Harvard University, significantly impacting its overall finances. With an astonishing endowment value of $53 billion, Harvard navigates complex challenges as it balances the immediate demands of the institution with long-term financial health. This wealth provides essential resources for everything from faculty positions to groundbreaking research, yet it also comes with restrictions that limit flexibility in spending. As financial challenges such as economic downturns and changes in federal funding loom, the university’s investment strategies must adapt to safeguard its future. Understanding the intricacies behind Harvard’s endowment and the implications of its financial management is crucial for grasping how the institution maintains its prestigious status and supports its community.

The management of Harvard’s vast endowment is a key aspect of maintaining the university’s economic stability and supporting its academic missions. By overseeing substantial financial reserves, Harvard’s executive team must continually strategize to address both immediate organizational needs and future growth potential. The complexities of these endowment investment strategies, especially when factoring in the impact of donor-imposed restrictions, reveal a delicate balancing act that the institution must perform. Moreover, as it faces ongoing financial challenges, it becomes increasingly important to scrutinize how these funds are utilized in fostering educational opportunities and advancing research initiatives. Ultimately, examining the broader implications of Harvard’s financial decisions sheds light on the institution’s approach to sustaining its influence in the realm of higher education.

Understanding Harvard University Finances

Harvard University’s finances are underpinned by an extensive endowment, which is crucial for its sustainability and operational flexibility. With an endowment currently valued at $53 billion, this financial reservoir enables the university to support various initiatives, including academic programs, scholarships, and research projects. However, the complexities of donor restrictions mean that not all these funds can be utilized at the university’s discretion. In fact, much of this endowment is earmarked for specific purposes aligned with donor intentions, which complicates the financial landscape for university leadership.

The limitations imposed by these restrictions become particularly impactful during challenging financial climates. For instance, as external funding becomes uncertain—due to policy changes or economic downturns—Harvard must navigate its budgetary decisions with great care. While the endowment serves as a safety net, navigating these restrictions takes strategic planning and foresight to ensure both immediate needs and long-term goals are met, maintaining a balance that can foster academic excellence despite financial hurdles.

The Risks and Rewards of Endowment Investment Strategies

While the Harvard endowment has historically delivered robust returns, the investment strategies employed are not without their risks and rewards. The university relies on a mix of assets, from stocks to alternative investments, to achieve an annual return target of around 8 percent. Such goals necessitate a careful balance of seeking high returns while managing the volatility that can accompany aggressive investment strategies. Harvard has often employed a diversified approach, which mitigates risks but also demands savvy management to adjust for fluctuating market conditions.

Nevertheless, there are inherent risks related to these strategies. As seen during periods of economic recession, even well-poised investments can falter, leading to significant discrepancies in endowment value. University leaders must continually assess their investment frameworks to ensure that they adapt to changing market dynamics. A reliance on past performance can lead to complacency, underscoring the need for a forward-looking approach that accounts for both worst-case scenarios and opportunities for growth.

Financial Challenges Faced by Harvard

Harvard faces a myriad of financial challenges that are exacerbated by both external pressures and internal budgeting practices. Recent tensions with government policies put federal research funding at risk, which could dramatically impact the university’s operational budget. Such uncertainties compel Harvard to reassess its financial strategies and reliance on endowment distributions to cover deficits. The perpetual need for innovation in financing education while accessing diverse funding sources remains critical in navigating today’s complex financial landscape.

Moreover, adjustments in governmental funding models and public sentiment can create additional layers of challenge. Increasing scrutiny on elite institutions regarding their tax statuses and national responsibilities may further complicate fundraising efforts. As pressures mount, it becomes essential for the university to establish robust contingency plans, leveraging the flexibility offered by its endowment while aligning with its mission of providing world-class education.

Impact of Endowment Restrictions on Financial Planning

The restrictions placed on Harvard’s endowment profoundly impact financial planning and budget allocation within the university. As highlighted by economists, a significant portion of the endowment is designated for specific uses, meaning that university leaders must prioritize how to allocate funds without breaching donor agreements. This intricate balance creates a challenge, especially during downturns when flexibility is paramount to sustaining programs and services that differentiate Harvard from other institutions.

Financial planning must therefore incorporate a robust understanding of the implications that endowment restrictions carry. Leaders must not only plan for annual distributions but also consider how these constraints might limit future opportunities for expansion or innovation. By acknowledging these limitations early in the budgeting process, Harvard can better strategize its financial health, ensuring that it remains a leader in education despite funding obstacles.

Long-term Implications of Harvard’s Endowment Management

The management of Harvard’s endowment is not just a matter of maintaining financial health; it has sweeping implications for the university’s long-term strategic direction. As leadership navigates the complexities of investment returns, spending policy, and donor restrictions, it must also remain vigilant to external changes that could jeopardize financial stability. Factors such as government funding trends, economic conditions, and public perception of higher education influence how the endowment functions and its capacity to meet future needs.

Furthermore, the decisions made today can have ripple effects for years to come, particularly in how Harvard allocates its financial resources. Careful planning and adaptable strategies will be needed to address these evolving challenges while also seizing opportunities. The endowment offers flexibility, but utilizing it sensibly requires foresight, prudence, and often a willingness to make difficult trade-offs to ensure Harvard’s long-term success.

Harvard’s Strategic Vision Amid Financial Uncertainty

Navigating financial uncertainty requires a strategic vision that encompasses both immediate concerns and long-standing objectives. Harvard’s leadership recognizes that the endowment plays a critical role in realizing the university’s mission and must therefore be managed with care. Given the unpredictability of funding sources and economic trends, developing a strategic framework that accounts for potential risks while positioning the university for stability and growth is paramount.

Additionally, Harvard must engage its stakeholders—including faculty, administrators, and alumni—in conversations about financial priorities and constraints. This collaborative approach fosters a culture of transparency and shared responsibility, ensuring that financial planning aligns with the university’s academic mission. By inspiring confidence in its financial stewardship, Harvard can effectively advocate for its objectives and secure the necessary support for its vision.

Leveraging Harvard’s Endowment for Innovation

Harvard’s endowment, while primarily a resource for funding operations, also represents a significant opportunity for innovation and advancement within the university. By strategically leveraging this financial asset, Harvard can invest in cutting-edge research projects, faculty recruitment, and student scholarships, all of which contribute to its status as a leading academic institution. The potential for transformative impact is considerable when endowment funds align with initiatives that push boundaries and enhance the educational experience.

However, fostering innovation through endowment spending must be executed thoughtfully to maintain long-term sustainability. University leaders need to strike a balance between funding immediate projects and ensuring that future financial health is not compromised. Through careful evaluation of which projects to support and how to allocate resources, Harvard can utilize its endowment to not only respond to current challenges but also set the stage for ongoing success.

The Future of Endowment Management at Harvard

The future of endowment management at Harvard will likely be shaped by ongoing changes in the educational landscape, economic conditions, and regulatory frameworks. As the environment surrounding higher education evolves, Harvard must adapt its strategies to meet these challenges and capitalize on emerging opportunities in investment and financing. This includes exploring innovative investment approaches and diversifying revenue streams to enhance stability.

Moreover, as the influence of public opinion grows in shaping policy, effective communication about Harvard’s financial stewardship and commitment to its educational mission is more important than ever. By actively engaging stakeholders and addressing the complexities surrounding the endowment, Harvard leaders can work to fortify the university’s position and prepare it for a dynamic and uncertain future. Ultimately, a proactive approach to endowment management will be essential in safeguarding not just funds, but the broader mission of Harvard University.

Frequently Asked Questions

What are the main responsibilities of Harvard University in managing its endowment?

Harvard University is tasked with the stewardship of its endowment, which includes making investment decisions that align with the University’s long-term financial goals. The Harvard Management Company oversees these investments, aiming for sustainable growth while navigating challenges that may arise from donor restrictions and the need for financial aid.

How does Harvard University finances impact its endowment management strategy?

Harvard University’s finances are profoundly influenced by endowment management strategies. The endowment provides a critical revenue source used to support financial aid, research, and operational costs. However, due to donor restrictions, much of this wealth is earmarked, limiting the flexibility of funds available for various spending initiatives.

What are the implications of endowment investment strategies on Harvard’s financial challenges?

Endowment investment strategies play a vital role in addressing Harvard’s financial challenges. The University relies on projected returns to generate funds for operations and aid. Poor investment performance or unforeseen economic downturns can strain finances, prompting the need for strategic adjustments in spending and fund allocation.

How do endowment restrictions affect Harvard University’s financial operations?

Endowment restrictions impose significant limitations on how Harvard can utilize its funds. Since a large portion of the endowment is designated for specific purposes defined by donors, the University often faces challenges in balancing immediate operational needs with long-term financial health. This restriction can complicate financial strategies and necessitate reliance on other revenue streams.

What are the potential risks associated with Harvard’s endowment management approach?

The approach to Harvard’s endowment management entails risks such as market volatility, which can significantly impact investment returns. Additionally, over-reliance on the endowment for current expenses may lead to tighter budgets in the future, especially during economic downturns or changes in federal funding, affecting the University’s long-term viability.

How does Harvard manage endowment distributions to ensure financial stability?

Harvard manages endowment distributions by employing a strategy of smoothing annual payouts, which helps to stabilize spending during fluctuating economic conditions. By projecting returns and adjusting the distribution rate cautiously, the University aims to maintain a balance between addressing current needs and ensuring the sustainability of the endowment over the long term.

What recent changes in federal funding could impact Harvard’s endowment management?

Recent proposals for freezing federal funding for research and potential threats to Harvard’s tax-exempt status could severely impact the University’s endowment management. These financial challenges would require a reevaluation of spending strategies and could compel Harvard to make fundamental adjustments to its financial operations to maintain stability.

In what ways does Harvard’s endowment contribute to financial aid programs?

Harvard’s endowment plays a crucial role in financing its generous financial aid programs. A significant portion of the annual distribution from the endowment is allocated to support student financial aid, which helps to ensure access to education for a diverse student body, reflecting Harvard’s commitment to affordability and inclusion.

Why is understanding the dynamics of Harvard endowment management important for stakeholders?

Understanding the dynamics of Harvard’s endowment management is essential for stakeholders, including alumni, donors, and policymakers, as it reveals how effectively the University can navigate financial challenges, support academic excellence, and sustain long-term growth. Awareness of these factors can influence future investments and the expectations of institutional transparency.

| Key Points |

|---|

| Harvard’s endowment reached a record $53 billion, but most is restricted and tied to specific schools, limiting flexible use. |

| Less than 5% of the endowment is unrestricted and fully accessible to university leadership. |

| Endowments can mitigate financial uncertainties but may lead to future budget constraints. |

| Decisions regarding endowment spending impact long-term budgeting and financial health. |

| Exogenous shocks like financial crises and emergency situations may prompt increased distributions. |

| Harvard’s financial strategy relies on projected returns and smoothing effects of volatility. |

| Future fiscal scenarios need careful analysis to adjust long-term spending and revenue sources. |

Summary

Harvard endowment management plays a crucial role in the university’s financial health, balancing between immediate needs and long-term sustainability. As illustrated by the complexities of Harvard’s $53 billion endowment, the majority of funds are restricted, limiting flexibility in spending. Consequently, while the endowment can provide essential resources during financial uncertainties, it also imposes future budgetary constraints. Effective management requires strategic foresight to navigate potential downturns and ensure Harvard can fulfill its mission while adapting to an evolving funding landscape.